With the recent market events, you probably noticed that the term Proof-of-Reserves or PoR emerges every time any crypto exchange is mentioned.

To learn what is PoR, how it’s used, and why it matters continue reading this article.

What is Proof-of-Reserves (PoR)?

* It is not a consensus mechanism.

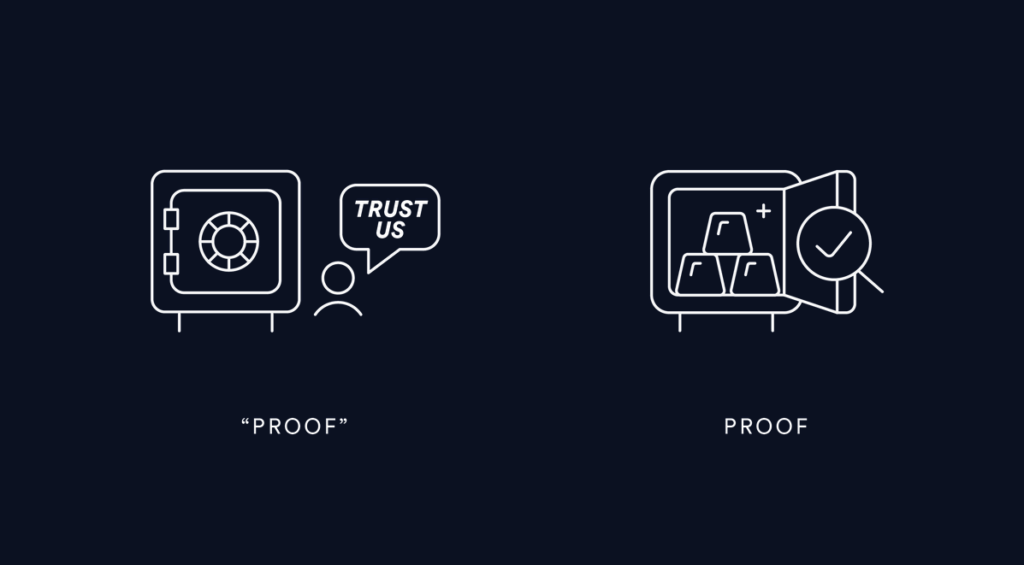

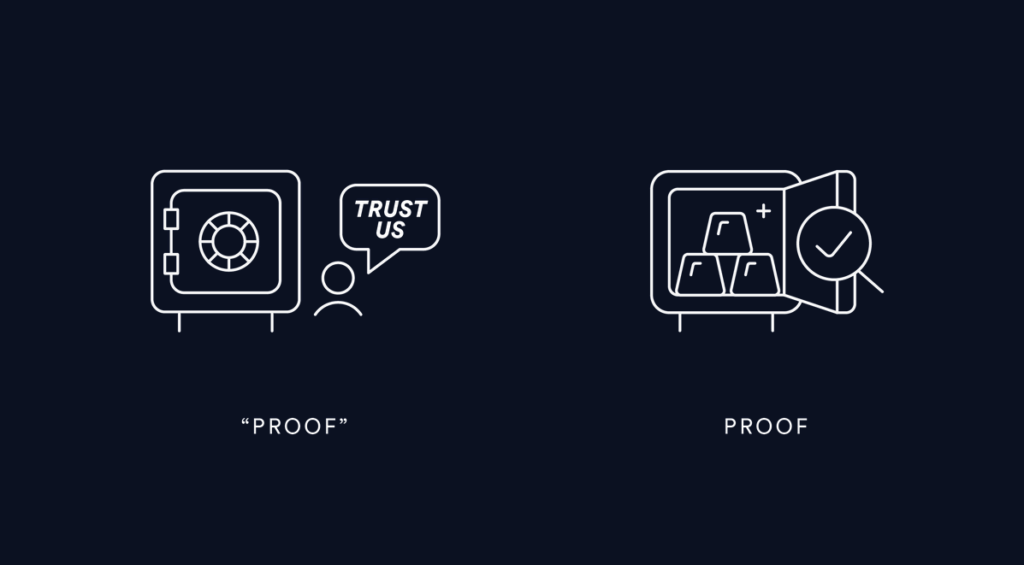

Proof-of-Reserves, or short PoR is a publicly shared and verified background check or an independent audit conducted on crypto exchanges by a third-party auditor.

It is a way for a CEX (centralized exchange e.g. Binance, Crypto.com, Coinbase) to provide transparency by revealing in public that they hold in their reserves enough assets to match user deposits. The goal of Proof-of-Reserves is to ensure both their users and the public that the exchange is financially stable and that it carries an amount either equal to or greater than the sum of the clients’ balance.

To put it simply, it is official proof that your investments really are safe.

Source: Chainlink

So far the exchanges that have announced they will publish their PoRs are Binance, Bitfinex, Bitget, Bybit, Crypto.com, Deribit, Huobi, KuCoin, OKX, and Poloniex.

Why Proof-of-Reserves matter? Is it really necessary?

Well, public transparency blocks a crypto exchange from making any secretive financial transactions, such as for example, loaning out more money than the collateral it holds and risking insolvency.

By providing Proof-of-Reserve audits:

- Exchanges communicate that the clients’ assets are protected

- They help users make more informed decisions by providing an unbiased and completely honest picture of their funds

- Exchanges gain users’ trust

With that being said, we will leave it to you to conclude if Proof-of-Reserve matters, and whether it should be necessary for every crypto exchange. 😊

🔐 “Not your keys, not your coins”

Let’s make some things clear – both CEXes and DEXes should exist.

Centralized exchanges are really convenient for both newcomers and existing traders. They are usually compliant with government regulations and are easy to use, even for beginner traders. You get benefits and rewards, credit cards to use, etc. They come with customer support teams that can help you out if you run into trouble. But the truth is they need a better trustless model.

Just recently Vitalik gave his proposal on how we can make CEXs more safe and trustless by using cryptographic techniques 👇👇👇

We always say that you should use CEX or DEX for transactions, but the majority of your assets should ALWAYS be stored on a hardware wallet. After all, the expression “Not your keys, not your coins” does not exist in vain. 😁

Therefore we encourage you to be proactive and read more about this topic by using the recommended resources listed below.

More recommended reading:

If you want to keep up with the news on what Shard Labs is currently working on, follow us on Twitter and Medium. If you have any questions, feel free to reach out.

This article was originally published by Shard Labs on Medium, where people are continuing the conversation by highlighting and responding to this story.